XRP Price Prediction: Technical Bearishness vs. Fundamental Growth Potential

#XRP

- XRP trades below key technical levels but shows potential stabilization signals

- Ripple's ecosystem expansion through lending protocols and DeFi upgrades provides fundamental support

- The $2.77 Bollinger Band support level is critical for determining near-term direction

XRP Price Prediction

XRP Technical Analysis: Bearish Signals Dominate Short-Term Outlook

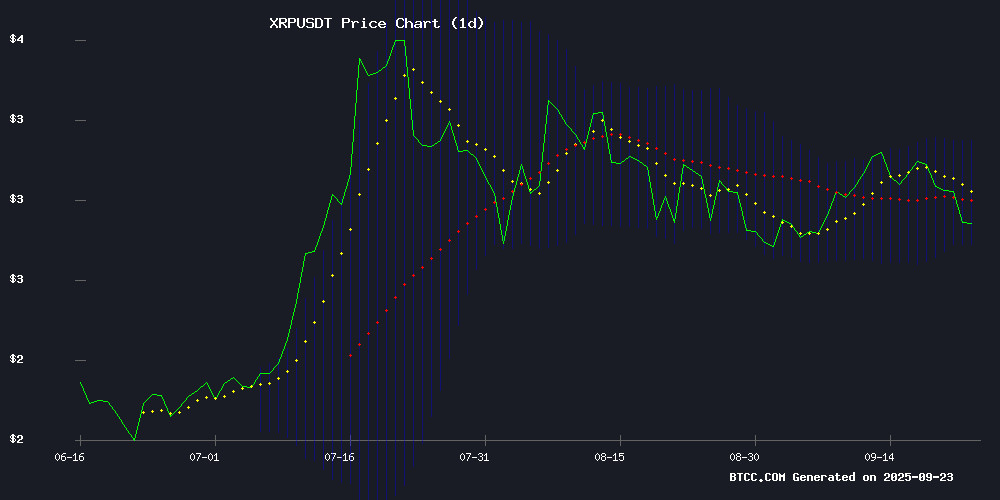

XRP is currently trading at $2.86, below its 20-day moving average of $2.97, indicating near-term bearish pressure. The MACD shows negative momentum with the histogram at 0.0046, though the convergence between MACD and signal lines suggests potential stabilization. Bollinger Bands position the price NEAR the lower band at $2.77, which could act as support. According to BTCC financial analyst Olivia, 'The technical picture shows XRP struggling to maintain above key levels, with the $2.77 support being critical for any bullish reversal.'

Mixed Fundamentals: XRP Ecosystem Expands Amid Price Pressure

Ripple's recent upgrades to the XRP Ledger, including native lending protocols and institutional DeFi tools, contrast with the current price action below $3. The launch of mXRP for yield generation and renewable energy mining expansion provides long-term bullish fundamentals. Olivia notes, 'While technicals show short-term weakness, the fundamental developments in XRP's ecosystem could drive adoption, though market sentiment remains cautious until price confirms a reversal above $3.'

Factors Influencing XRP's Price

Ripple Unveils Native Lending Protocol for XRP Ledger in Major Upgrade

Ripple has announced a native lending protocol for the XRP Ledger (XRPL), set to launch with Version 3.0.0 later this year. The protocol will introduce pooled lending and underwritten credit directly on the ledger, leveraging Single-Asset Vaults and Lending Protocol specifications. This move solidifies XRPL's position as a key player in institutional DeFi.

The XRP Ledger has already achieved over $1 billion in monthly stablecoin volume and ranks among the top ten blockchains for real-world asset activity. Zero-knowledge proofs, planned for Q1 2026, will enhance privacy while maintaining compliance. The Multi-Purpose Tokens standard will enable representation of complex financial instruments like bonds and structured products.

Fleet Asset Management Group Expands XRP Cloud Mining with Renewable Energy Model

Fleet Asset Management Group (FLAMGP) has introduced a contract-based cloud mining service targeting XRP holders, offering an alternative to speculative trading. The platform reports daily earnings up to $77,700 through renewable energy-powered operations, emphasizing security and carbon-neutral processes.

The model provides daily settlements and flexible withdrawal options, with a $15 sign-up bonus for new users. FLAMGP's infrastructure runs entirely on wind, solar, and intelligent storage systems, aligning with growing demand for sustainable crypto solutions.

Ripple Unveils Institutional-Focused DeFi Upgrades on XRPL With Lending and Compliance Tools

Ripple is aggressively positioning the XRP Ledger (XRPL) as a foundational infrastructure for institutional finance. A suite of new upgrades targets compliance, lending, and privacy—key pain points for traditional financial players entering decentralized finance.

The protocol has already demonstrated institutional-grade capacity, processing over $1 billion in stablecoin volume during a single month. XRPL now ranks among the top 10 blockchains for real-world asset activity, signaling its transition from experimental pilots to production-scale adoption.

At the core of these developments lies a native lending protocol engineered for regulatory compatibility. This on-chain credit system reduces costs while maintaining compliance through Credentials—a decentralized identity solution enabling KYC verification and accreditation checks.

Security enhancements include Deep Freeze functionality, allowing issuers to halt transactions from flagged accounts. This feature addresses critical risk management requirements for stablecoin issuers and RWA providers operating under strict regulatory scrutiny.

Developer tools like Simulate provide transaction preview capabilities, mitigating execution risks for high-value institutional transfers. Combined with batch processing, permissioned DEX features, and advanced escrow mechanisms, these upgrades solidify XRPL's position as a bridge between traditional finance and decentralized systems.

XRP Price Drops Below Key $3 Support as Bearish Signals Emerge

XRP's price tumbled 5% in 24 hours, slipping below the critical $3 support level to trade near $2.80. The decline marks a continuation of weakness after the token failed to sustain gains above $3.12 earlier this week.

Technical charts reveal a concerning descending triangle pattern, suggesting potential further downside toward $2.07. The token now trades below key moving averages, with resistance forming near $2.92. Market indicators point to a possible local top at $3.18 based on Net Unrealized Profit/Loss data.

Despite the short-term bearish momentum, some analysts maintain optimism about XRP's long-term prospects. The cryptocurrency briefly touched $2.678 during Monday's selloff before paring some losses, though it remains firmly in bearish territory below crucial technical levels.

New Token mXRP Converts XRP Holdings into Yield-Generating Assets

Midas and Interop Labs have introduced mXRP, a liquid-staking token designed to unlock yield potential for idle XRP holdings. The ERC-20 compatible asset offers 6%-8% returns through DeFi integrations on XRPL's EVM sidechain—marking a strategic evolution for XRP's utility beyond payments.

"This isn't a savings account clone," emphasizes Dennis Dinkelmeyer, Midas CEO. The tokenization process converts deposited XRP into yield-bearing mXRP certificates, deployable across decentralized protocols. Early adopters gain exposure to emerging DeFi infrastructure while maintaining liquidity.

XRP Price Stagnation Persists Despite Legal Clarity

XRP's price stagnation can no longer be attributed to the SEC lawsuit, according to pro-XRP lawyer Bill Morgan. Ripple's $125 million settlement with the regulator has removed a major legal overhang, yet the token continues to trade flat around $2.80—defying expectations of a post-lawsuit rally.

The launch of XRP's first U.S. ETF failed to ignite momentum, while adoption growth contrasts sharply with stagnant price action. Market participants now seek explanations beyond legal factors for the disconnect between fundamentals and valuation.

Ripple's three-year legal battle with the SEC had previously driven XRP's volatility, with the 2020 securities offering allegations creating sustained uncertainty. The resolution was expected to serve as a catalyst, but the market response remains muted.

Ripple CTO Predicts XRP as Key to Trillions in Banking Future

Ripple's Chief Technology Officer has outlined a transformative vision for XRP, positioning it as a cornerstone of global banking infrastructure. Major financial institutions, including DBS and Franklin Templeton, are already leveraging XRP for payments and exploring tokenized asset solutions. One bank is reportedly planning to operate entirely on the XRP Ledger.

The company is actively pursuing regulatory approvals, including a New York banking charter and Federal Reserve master account. Ripple's alignment with ISO 20022 messaging standards further underscores its ambition to dominate large-scale settlement and cross-border transactions. This strategic push comes as institutional adoption of digital assets reaches an inflection point.

Ripple Unveils DeFi Roadmap for XRP Ledger, Targeting Institutional Finance

Ripple has laid out a comprehensive development plan for the XRP Ledger (XRPL), positioning it as a contender in the race to tokenize real-world assets (RWAs) and attract regulated financial institutions. The roadmap, announced on September 22, 2025, introduces a suite of tools designed to enhance institutional participation, including a native lending protocol and advanced compliance features.

The upcoming XRPL Version 3.0.0, pending validator approval, will focus on compliant on-chain credit markets and RWA tokenization. A key highlight is the XLS-66 specification, enabling pooled lending and underwritten credit at the ledger level. The Multi-Purpose Token (MPT) standard will facilitate the representation of complex financial instruments like bonds.

Privacy enhancements are also in the pipeline, with Zero-Knowledge Proofs (ZKPs) slated for integration in early 2026. Confidential MPTs will be the first application, offering transactional privacy for institutional users. Existing tools like Credentials for identity verification and Deep Freeze for asset control underscore Ripple's emphasis on regulatory compliance.

XRP's $20 Target: A High-Bar Scenario Requiring Massive Market Cap Growth

XRP faces a steep climb to reach $20, a price point that would require its market capitalization to surge from $182 billion to approximately $1.196 trillion—a 6.6-fold increase. At current trading levels of $3.04, achieving this milestone would demand unprecedented institutional adoption, ETF inflows, and real-world utility.

The math is unforgiving: XRP's circulating supply of 59.8 billion tokens would need to absorb $1.2 trillion in capital inflows, capturing nearly 29% of the total crypto market. Such growth would hinge on coordinated developments—bank adoption of the XRP Ledger for payments, tokenized asset use cases, and regulatory clarity enabling institutional participation.

Market veterans note this scenario isn't impossible but would require years of sustained ecosystem development. The absence of major exchange-traded products for XRP remains a critical hurdle compared to assets like Bitcoin and Ethereum.

XRP Steps Up in DeFi with mXRP Launch: Will It Meet Expectations?

Midas has introduced the mXRP token in partnership with Axelar and Interop Labs, marking a significant push to expand XRP's utility in decentralized finance. The token offers yields of up to 8%, leveraging tokenized exposure to both on-chain and off-chain strategies.

Launched on the XRPL EVM via audited smart contracts, mXRP is fully integrated into the DeFi ecosystem. Axelar's bridging technology enables cross-chain functionality, allowing the token to operate across more than 80 blockchains, significantly enhancing its accessibility.

The product aims to deliver scalable and durable yields, with an APY range of 6% to 8%, based on historical performance. This initiative underscores the growing demand for yield-generating assets in the DeFi space.

XRP and Remittix: 2026 Price Projections and Market Potential

XRP is capturing market attention with bullish 2026 price targets ranging between $4 and $6, contingent on regulatory clarity and adoption growth. Some analysts project a surge to $10 under optimal conditions, driven by institutional interest and cross-border payment momentum. Currently trading near $2.98, XRP faces resistance at $3.20-$3.50, with its upside potential tempered by its established market cap and broad usage.

Remittix emerges as a disruptive newcomer, drawing comparisons to Ripple’s early days. Experts highlight its early-stage growth potential, positioning it as a high-reward alternative to XRP. While XRP’s trajectory reflects maturity, Remittix offers speculative upside akin to Ripple’s breakout years—if its roadmap delivers on its promises.

Is XRP a good investment?

XRP presents a complex investment case balancing technical weakness against strong fundamental developments. Currently trading at $2.86, below key support levels, the short-term technical outlook appears bearish. However, Ripple's ecosystem expansion through new lending protocols, institutional DeFi tools, and yield-generating assets like mXRP provides long-term growth potential.

| Metric | Current Value | Implication |

|---|---|---|

| Price | $2.86 | Below key $3 support |

| 20-day MA | $2.97 | Resistance level |

| Bollinger Lower Band | $2.77 | Critical support |

| MACD Histogram | 0.0046 | Weak bullish momentum |

According to BTCC financial analyst Olivia, 'Investors should monitor the $2.77 support level closely. A break below could signal further downside, while successful defense of this level combined with positive ecosystem developments could make XRP an attractive long-term investment.'